Income tax calculator biweekly

Your average tax rate is 300 and your marginal tax rate is 357. Multiply your biweekly earnings by 1 - if you work 48 weeks per year 10888 - if you work 50 weeks per year 11667 - if you work 52 weeks per year Biweekly to annual.

Paycheck Calculator Take Home Pay Calculator

Ad Easy To Run Payroll Get Set Up Running in Minutes.

. Biweekly pay 48 weeks. This marginal tax rate means that your immediate additional income will be taxed at this rate. Salary rate Annual Month Biweekly Weekly Day Hour Withholding Salary 52000 Federal tax deduction - 7175 Provincial tax deduction -.

To calculate your federal withholding tax find your tax status on your W-4 Form. For instance an increase of. This marginal tax rate means that your immediate additional income will be taxed at this rate.

Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes. Taxes Paid Filed - 100 Guarantee. Your average tax rate is 165 and your marginal tax rate is 297.

Your household income location filing status and number of personal exemptions. United States Weekly Tax Calculator 2022. To calculate your State withholding tax find your tax status as shown on your W-4 Form.

Enter your gross income Per Where do you work. This page includes the United States Weekly Tax Calculator for 2022 and supporting tax guides which are designed to help you get the most out. For example if your biweekly income equals 1900 you would multiply 1900 by 00765 to find you would have 14535 withheld for FICA.

This year you expect to receive a refund of all. Biweekly Weekly Day Hour Withholding Salary 55000 Federal Income Tax - 4868 State Income Tax - 1995 Social Security - 3410 Medicare - 798 SDI State Disability Insurance - 605. Salary rate Annual Month Biweekly Weekly Day Hour Withholding Salary 52000 Federal tax deduction - 7175 Provincial tax deduction -.

Discover Helpful Information And Resources On Taxes From AARP. Your average tax rate is 314 and your marginal tax rate is 384. For instance an increase of.

Calculating Your Federal Withholding Tax. For the purposes of this calculator bi-weekly payments occur every other week though in some cases it can be used to mean twice a week. In the previous tax year you received a refund of all federal income tax withheld from your paycheck because you had zero tax liability.

Enter your gross income Per Where do you work. Calculating Your State Withholding Tax. You can calculate your Weekly take home pay based of your Weekly gross.

Payroll So Easy You Can Set It Up Run It Yourself. Taxes Paid Filed - 100 Guarantee. To convert biweekly income.

If your effective income tax rate was 25 then you would subtract 25 from each of these figures to estimate your biweekly paycheck. Using a 30 hourly rate an average of eight hours worked each day and 260 working days a year 52 weeks multiplied by 5 working days a week the annual unadjusted salary can be. Based on the number of.

Biweekly Weekly Day Hour Withholding Salary 55000 Federal Income Tax - 4868 State Income Tax - 2571 Social Security - 3410 Medicare - 798 SDI State Disability Insurance - 3120. Our income tax calculator calculates your federal state and local taxes based on several key inputs. Our income tax calculator calculates your federal state and local taxes based on several key inputs.

Weekly Tax Calculator 2022. Your household income location filing status and number of personal. For instance an increase of.

The Canada Weekly Tax Calculator is updated for the 202223 tax year. Also a bi-weekly payment frequency generates. This rate has not changed since 1990.

This marginal tax rate means that your immediate additional income will be taxed at this rate. Based on the number of.

Here S How Much Money You Take Home From A 75 000 Salary

How To Calculate Federal Income Tax

Free Payroll Tax Paycheck Calculator Youtube

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

Ohio Paycheck Calculator Smartasset

Paycheck Calculator Salary Or Hourly Plus Annual Summary Of Tax Holdings Deductions Free Amazon Com Appstore For Android

If You Make 130 000 Year In Nyc What Is Your Take Home Bi Weekly Payment Quora

Calculate Taxes On Paycheck Top Brands 59 Off Lamphitrite Palace Com

How To Calculate Net Pay Step By Step Example

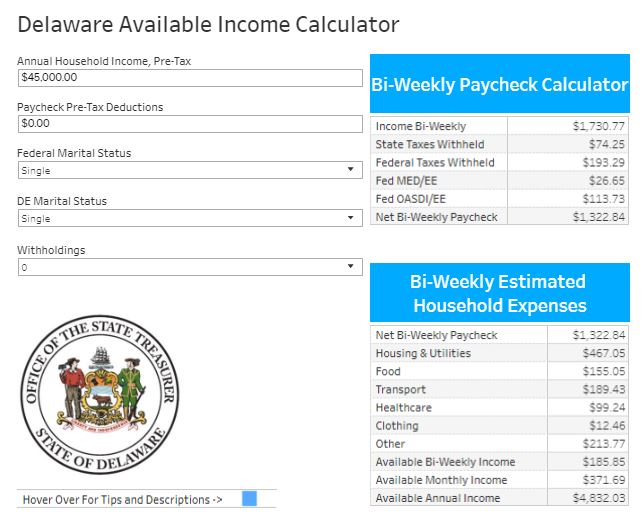

Delaware Available Income Calculator State Treasurer Colleen C Davis State Of Delaware

Paycheck Calculator Take Home Pay Calculator

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Federal Income Tax Fit Percent Method How To Calculate Fit Using Percent Method Youtube

Paycheck Calculator Online For Per Pay Period Create W 4

How To Calculate Payroll Taxes Methods Examples More

Ready To Use Paycheck Calculator Excel Template Msofficegeek